September 2024 Housing Market Update

As we step into September 2024, the housing market across Australia shows signs of a cooling trend despite a continued rise in home values on a national level. This blog will delve into the latest statistics, trends, and insights from the housing market, providing a comprehensive overview of what to expect as we move forward.

National Overview

National Overview

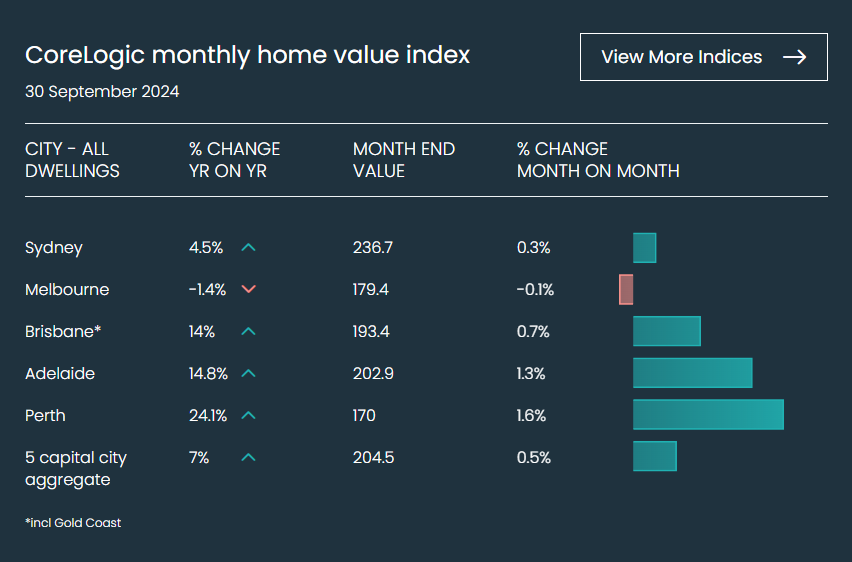

The CoreLogic national home value index has reported a modest increase of half a percent, marking the nineteenth consecutive month of rising values. However, it's important to note that this growth is less than half the rate recorded during the same period last year. There remains a higher demand for housing compared to available supply, but the balance is shifting as advertised supply begins to increase.

Interestingly, the total listing numbers in Melbourne are now almost thirty percent above the previous five-year average, while listings in Perth and Adelaide are tracking close to forty percent below the same average. This divergence highlights the varied dynamics across different regions of Australia.

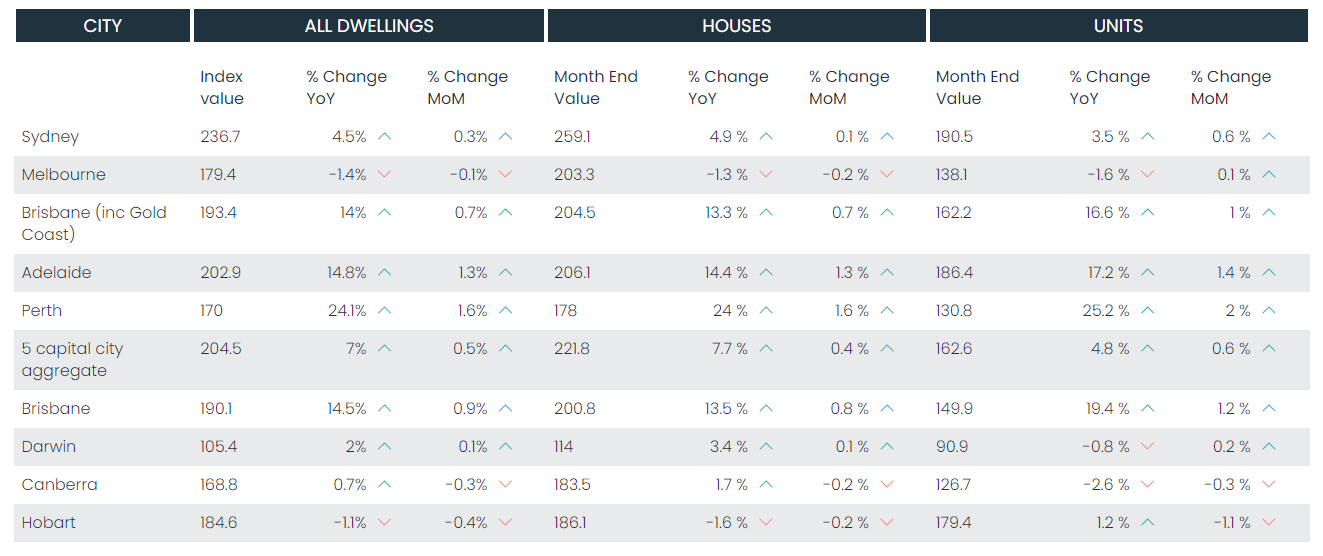

Capital growth remains diverse, with mid-sized capitals leading the charge, showing monthly increases between one to two percent. In contrast, Sydney's growth has slowed to just 0.3%, and Melbourne, Hobart, Canberra, and Darwin have all experienced declines in home values.

Affordability Challenges

Affordability Challenges

Despite some markets seeing improved affordability, many regions are still grappling with affordability constraints. The ongoing outperformance of cheaper markets underscores this trend, with the lower quartile of combined capital cities rising by 2.7% in the three months to August, compared to a mere 0.3% lift across the upper quartile.

Affordability pressures are particularly evident in larger capital cities, where housing values are becoming increasingly difficult for average households to manage in the wake of elevated interest rates and rising living costs. As the market shifts towards lower price segments, it's crucial to keep an eye on these affordability metrics.

Changes in Housing Hierarchy

Changes in Housing Hierarchy

August brought about significant changes in the hierarchy of housing values across capitals. Notably, Melbourne's median dwelling value has been overtaken by both Adelaide and Perth, marking the first time Perth's median value has surpassed Melbourne's since February 2015. Similarly, this is also the first instance of Adelaide having a higher median than Melbourne in CoreLogic's forty-year history.

This shift is attributed to the different trajectories of housing values in these regions, with Perth and Adelaide seeing rising values while Melbourne's values have been declining.

Rental Market Insights

Rental Market Insights

The rental market is also experiencing notable changes. The national rental index remained unchanged for the second consecutive month in August, with Sydney seeing a decline in rents for the second month in a row. While national rent values are still up 7.2% year-on-year, this is the lowest annual growth rate since May 2021.

On the demand side, net overseas migration has decreased, impacting rental demand, while on the supply side, investor trends vary by state. Nationally, investor loans secured were up 10.7% in the year to June, although dwelling completions remain a pressing issue due to a constrained construction sector.

Capital City Breakdown

Capital City Breakdown

Let's take a closer look at the housing trends in each capital city across Australia.

Sydney

Sydney's housing market has shown resilience, with values rising 0.3% in August. However, this growth is slowing down significantly compared to previous months. Rental conditions are also shifting, with a slight decrease in rents, indicating potential early signs of a downturn.

Melbourne

Melbourne continues to face a downturn, with values falling by 1.4% over the first eight months of the year. The rise in advertised stock levels, now 29% above the previous five-year average, reflects the challenging conditions in this market.

Brisbane

Brisbane's dwelling values have increased by 1.1% in August, although the pace of growth is moderating. The unit sector is performing particularly well, outpacing house values, which indicates a shift in buyer preference towards more affordable options.

Adelaide

Adelaide's housing market remains robust, with values increasing by 1.4% in August. The market continues to be driven by strong demand and low supply, with listings nearly 40% below the previous five-year average.

Perth

Perth is experiencing a remarkable upswing, with values increasing by 2% in August and an impressive annual growth of 24.4%. This growth is largely due to a shortage of available properties, leading to rapid sales.

Hobart

Hobart's dwelling values have slightly decreased by 0.1% in August, reflecting a broader trend of flat to declining values since early 2022. High advertised supply levels coupled with reduced home sales indicate a lack of demand.

Darwin

Darwin's dwelling values dipped by 0.2% in August, with a slight overall increase over the past year. The low supply of housing stock continues to impact the market, but demand is holding steady.

Canberra

Canberra's market is facing challenges, with values slipping 0.4% in August. The unit sector is particularly affected, but there is potential for recovery as the supply-demand balance shifts.

Looking Ahead

Looking Ahead

As we move deeper into the spring selling season, the national housing market is expected to see modest value increases. The ongoing lack of new supply, exacerbated by construction sector constraints, is likely to support housing values despite the current slowdown.

However, the risk of a loosening in the labor market and ongoing affordability issues could pose challenges in the coming months. As tax cuts and energy rebates improve household finances, the impact on home buying remains uncertain.

Conclusion

Conclusion

In conclusion, the Australian housing market is navigating a complex landscape, marked by varying trends across different regions. With continued monitoring of these trends, buyers and sellers alike can make informed decisions as they engage with the market.

Stay updated with the latest insights and research by visiting Altitude X: Wealth Through Smart Development.

ItfUGDkY6OE